IRS Publishes Tax Credit Guidance For 2023 Electric Vehicles

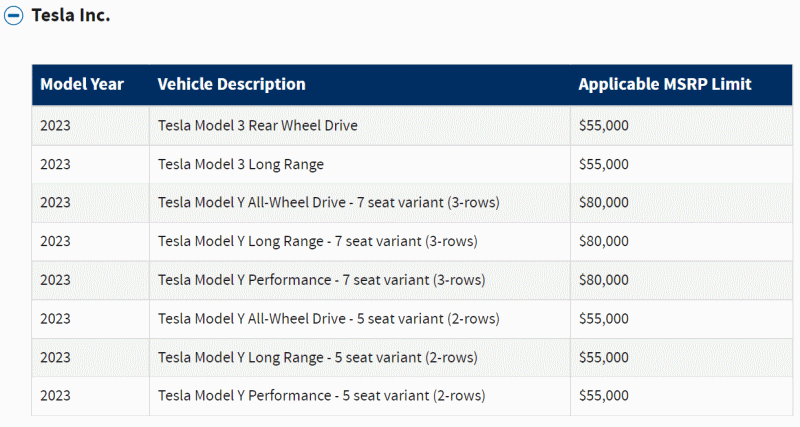

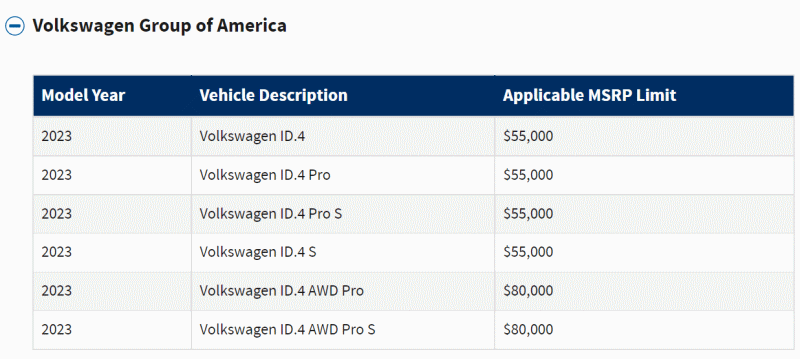

OK… I guess it takes seven seats, or is it all-wheel drive (AWD), to make an SUV? But why does AWD matter for the ID.4, but not the Model Y, or Mach-E? This matters because not-SUVs price out at $55,000 where SUVs are good to $80,000. There doesn’t seem to be a consistent theme in the IRS’s guidance around what feature mix in an electric vehicle (EV) makes one fall into which bucket for the $7,500 tax credit come January.

Tesla was the first one that caught my eye, because I think most people would classify the Model Y very clearly as an SUV. Now, it’s not Chevy Suburban sized, but still has all the hallmarks of, you know, an SUV. Oddly, it seems that the number of seats is what matters, not AWD, and not body style, because all Model Ys are functionally the same on the outside and come with AWD.

That seemed a bit weird, as a standard, given that Stellantis’s (Jeep/Chrysler) EVs were all SUVs, and AFAIK the Wrangler doesn’t have seven seats… Then I saw VW’s list. Where again, the ID.4 really only comes in one body style, but the distinction splits on whether it has AWD. But, when we look at the Ford Mustang Mach-E, which also has RWD and AWD options, they’re all not-SUV.

TBH, I feel kind of lost. Generally, been pretty good at finding the patterns in puzzle games, but this one has me stumped. Can someone please tell me what I’m missing?